2025 The Year of Private Labels

More premium, more sophisticated, better performing

The global fast-moving consumer goods sector in 2025 has undergone a definitive structural realignment, with private labels, also known as store brands, shifting from defensive budget alternatives to primary drivers of category growth and retailer differentiation. This report synthesises market data, executive commentary, and competitive signals to provide a comprehensive analysis of private-label performance for the 2025 financial period. The findings indicate that store brands have not only achieved record-breaking sales volumes but have also redefined consumer trust, functional value, and sustainability across global markets.

A Year of Structural Records

A significant divergence from the growth trajectories of national brands characterised the performance of private labels in 2025. While the broader industry faced headwinds from lingering inflation and shifting shopper missions, retailer-owned brands demonstrated resilience by capturing a larger share of both dollar spending and unit volume.

Global and Regional Sales Dynamics

In the United States, store brand sales reached an unprecedented 282.8 billion dollars for the 52 weeks ending 28 December 2025. This represents an increase of more than 9 billion dollars compared to 2024, reflecting a 3.3 per cent growth rate. By comparison, national brands grew by only 1.2 per cent in the same period, suggesting that private labels grew nearly three times as quickly as their branded counterparts.

The data indicates that the volume story is perhaps more telling than the revenue figures. Store-brand unit volume increased by 434.3 million units to a record 68.7 billion, a 0.6 per cent rise, while national-brand unit sales declined 0.6 per cent. This unit-level divergence highlights a fundamental shift in consumer behaviour, in which shoppers are actively choosing retailer-owned options to maintain their consumption levels amid persistent price pressures.

Regionally, Europe maintained its lead in private label penetration, with market shares approaching 40 per cent in 2025. In specific markets, such as the United Kingdom, private-label grocery sales reached 49.5 per cent, followed closely by Switzerland at 47.2 per cent. The United States remains in a developmental stage compared to these markets, holding approximately 21 per cent of the food and grocery market by value. However, the 30 per cent growth in US store brand dollar sales between 2021 and 2025 suggests a rapid narrowing of this gap.

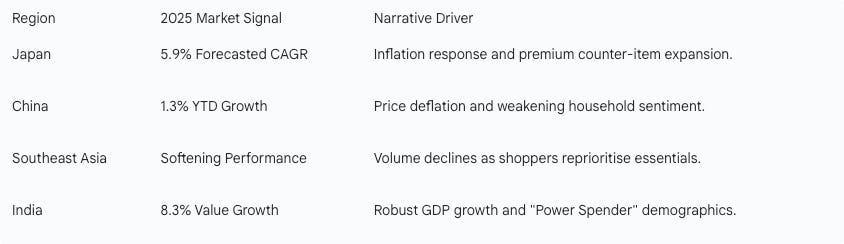

Regional Narratives: The Japan vs. APAC Divergence

A critical point of interest for leadership is Japan's performance compared to the broader Asia-Pacific region. While the regional market growth slowed to 2.5 per cent in the second quarter of 2025, Japan emerged as a significant growth engine. In Japan, the private label packaged food market is expected to grow at a compound annual growth rate of 5.9 per cent from 2025 to 2030. This resilience is driven by several factors that contrast with the regional trend. First, Japanese retailers such as Aeon and Seven & i Holdings have aggressively improved their own-brand lineups to attract customers struggling with soaring prices. The Topvalu brand from Aeon and the fresh food offerings at 7-Eleven have successfully capitalised on a smart value proposition that resonates with Japanese consumers who are increasingly budget-minded but quality-conscious.

In contrast, the broader Asia-Pacific region faced significant headwinds. China’s market recorded modest growth of only 1.3 per cent for the first three quarters of 2025, with price deflation accelerating by 2.4 per cent. While volume in China rose by 3.8 per cent, the decline in average selling prices reflects a competitive environment where consumers are balance-seeking and thoughtfully trading down. Southeast Asia also saw performance soften, with volumes down in categories like dairy and home care as shoppers in Indonesia and Malaysia reprioritised toward cheaper options or reduced their purchase frequency.

Category Breakdown

The success of store brands in 2025 was not uniform across all aisles. Certain departments emerged as clear leaders, reflecting broader consumer trends toward convenience, health, and wellness.

Refrigerated and Beverages: The refrigerated department led all categories in store-brand dollar sales growth, recording a 6.1 per cent increase. This was followed by beverages, which saw a 4.8 per cent increase in revenue and a 2.3 per cent rise in unit sales. These gains were often driven by higher-income shoppers, who are increasingly choosing store-branded juices, milk, and ready-to-drink coffee over national-brand equivalents.

Pet Care: Pet care was the standout performer in unit volume, with unit sales rising 5.4 per cent. This growth reflects the humanisation of pets and the increasing demand for functional nutrition products. Retailers have found success by offering premium-quality pet foods that include science-backed ingredients, effectively competing with specialist national brands.

Liquor and Beauty: Store brands in the liquor department posted a 4.4 per cent increase in unit volume, while the beauty department saw dollar sales grow by 2.8 per cent. In the beauty sector, the rise of clean beauty and vegan skincare has allowed retailers to introduce affordable, high-quality alternatives that resonate with Gen Z and Millennial consumers.

Strategic Takeaways

Store brands are achieving record unit share, reaching 23.5 per cent in the US, which signals a permanent shift in loyalty rather than a temporary inflation hedge. Volume growth for private labels at 0.6 per cent against a decline of 0.6 per cent for national brands indicates that branded price increases have reached a point of consumer rejection. Japan represents a high-value opportunity for retailers who can blend digital transformation with traditional quality standards. Category growth is increasingly concentrated in functional and premium niches, such as pet care nutrition and clean beauty.

The structural shift toward private labels in 2025 was driven by a confluence of macroeconomic pressures, retailers' operational improvements, and a fundamental change in consumer psychology.

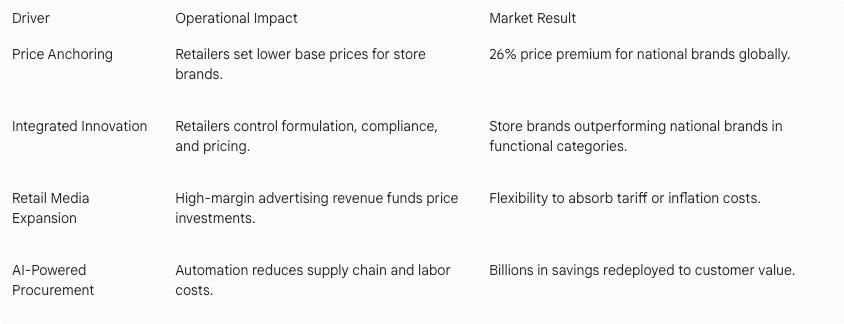

Pricing Power and the Erosion of National Brand Elasticity

For much of the past decade, national brands relied on price increases to drive revenue growth. However, in 2025, this strategy reached a saturation point. Consumer packaged goods inflation, while cooling from its 2023 peak, remained above global averages in some regions, with a 0.3 per cent increase between May 2024 and May 2025. This compounding effect has left consumers numb to volatility and highly selective in their spending. Store brands have capitalised on this by widening the price gap, which reached 86 per cent of national brand pricing in some European categories in 2025. Retailers have moved beyond treating private labels as simple margin fillers and now use them as category-leadership tools. By controlling formulation, pricing, and placement, retailers can respond to commodity cost fluctuations more nimbly than national brands, hindered by legacy pipelines.

Supply Chain Resilience and Speed to Market

In a year marked by geopolitical shocks and shipping disruptions, supply chain agility became a critical differentiator. Retailers have increasingly turned to nearshoring and friendshoring, moving production closer to their primary markets, to reduce emissions and secure supply. This localisation has another advantage: speed-to-shelf. National brands often face long validation cycles, whereas retailers can move from a consumer insight to a finished product in months rather than years. For example, 7-Eleven in Japan uses generative AI to improve the product innovation process for its food-to-go assortment. This allows store brands to lead trends such as functional foods and wellness products, rather than merely copying existing national brand hits.

Changes in Consumer Behaviour: The Smart Value Paradigm

The stigma previously associated with private labels has largely vanished. Shoppers are no longer choosing store brands solely because they are cheaper; they are choosing them because they are clearer, faster, and increasingly more trustworthy. Reports show that 68 per cent of global respondents now view store brands as good alternatives to name brands. This shift is particularly pronounced among high-income households. Consumers earning more than 100,000 dollars accounted for 75 per cent of Walmart’s share gains in 2025. These shoppers are trading down for essentials but finding they prefer the upgraded quality and modern store formats offered by retailers. This has led to the rise of smart value, where shoppers make deliberate choices based on trust and functional quality rather than brand heritage.

The pricing playbook used by national brands over the last three years is over; future growth must be driven by volume. Retail trust is compounding; once consumers trust a retailer for wellness or fresh food, the private label has an inherent advantage. High-income consumers are a permanent fixture in the store-brand demographic, requiring a focus on premium and niche private-label tiers. Speed to market is the new competitive frontline; retailers who can validate and scale ingredients in months will define shelf leadership.

The Voice of the Industry

Analysis of recent investor calls, analyst reports, and interviews reveals a complex landscape in which retailers are on the offensive and national brands are in a strategic reset.

C-Suite Commentary: Retailers on the Offensive

Executives from leading retailers are increasingly vocal about the strategic importance of private labels. Doug McMillon, CEO of Walmart, has explicitly stated the company’s intent to reduce inflationary pressures by keeping private-label prices low. He noted that Walmart is not participating in a recession if there is one and expects brand partners to eventually respond to the market pressure created by store brand value. At Tesco, CEO Ken Murphy highlighted the record performance of the Finest range, which grew by 18 per cent in the first quarter of 2025. Murphy observed that growth is multifaceted, driven by deeper distribution and a focus on affordable ways to treat themselves. The success of Finest suggests that premium private labels are effectively capturing the indulgence mission that was previously the domain of prestige brands. Peggy Davies, President of the PLMA, summed up the sentiment by stating that store brands increasingly compete and win on value, quality, health, and sustainability, not just price. This indicates a move away from a generic label toward a retailer-owned brand identity that shoppers can take pride in.

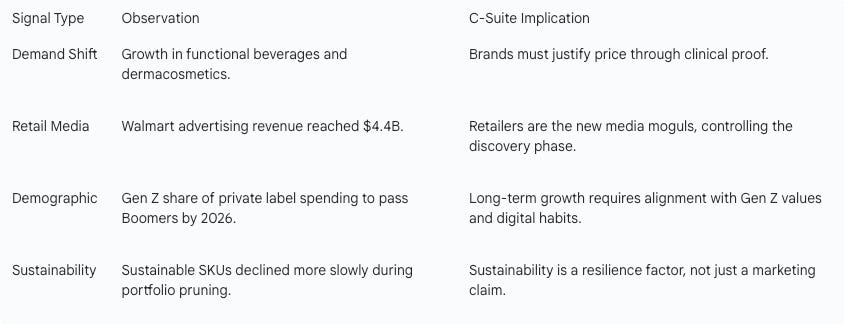

Analyst Signals: Consumption Saturation and ESG Table Stakes

Market analysts have identified several signals that affect the broader competitive landscape. One such signal is consumption saturation in certain formats. In markets like Romania, discounters have seen shopper traffic hold steady, suggesting a potential ceiling for the growth of traditional discount models. This is forcing retailers to seek growth through unconventional formats, such as new home and living test stores in Germany and specialist outlet zones in Poland. Sustainability has also transitioned from a differentiator to table stakes, a baseline expectation that brands must fulfil to remain on the shelf. Reports show that 63 per cent of private label launches in 2025 included a sustainability claim, surpassing the average for all products. However, the cost of sustainable packaging remains a significant pressure point, with recycled materials often commanding a premium that must be balanced against consumer price sensitivity.

Category Demand Shifts: From Utility to Identity

Analysts also point to a shift in how consumers define necessity. More than half of global respondents say that the brand name is becoming irrelevant for many everyday items, with necessity and functional benefit taking precedence. Categories like gut health, sleep, and healthy ageing are seeing double-digit growth, and private labels are capturing this by launching science-backed, wellness-driven offerings. This suggests that consumers are buying products that signal their lifestyle values, such as pet parenting or eco-conscious living, rather than just utility.

The C-Suite is using private-label as a competitive lever to pressure national-brand suppliers to lower their prices. Smart value has replaced budget as the primary driver of shopper loyalty. Retailers are diversifying into non-food and service formats to offset grocery saturation. Sustainability cost pressures are real, but failing to meet eco-expectations is a larger risk to brand value.

Strategic Benchmarking: The Health of Global Categories

Comparing retailers' trajectories with those of major conglomerates provides deep insight into the relative health of different categories.

National Brand Response: The Superiority Mandate

Global giants like Nestle, Unilever, and P&G have responded to the private label surge by refocusing on irresistible superiority and portfolio simplification. Nestle, under the leadership of Laurent Freixe, is executing a strategy to grow category performance through efficiency-funded investment. The company is addressing 18 underperforming business cells, which account for 21 per cent of group sales. Nestlé’s Fuel for Growth programme aims to save 2.5 billion CHF by 2027, with much of this being redeployed into advertising and marketing, which is planned to reach 9 per cent of sales by the end of 2025.

Unilever has undergone a significant transformation, including the demerger of its Ice Cream business. The company’s 30 Power Brands, which account for over 78 per cent of turnover, grew by 4.3 per cent in 2025, outperforming its non-power brands, which saw volume declines. CEO Fernando Fernandez has prioritised unmissable brand superiority, focusing on aesthetics, sensorials, and social-first demand generation. P&G continues to focus on its integrated strategy across five vectors of superiority: product, package, brand communication, retail execution, and value. The company reported a 2 per cent organic sales growth in fiscal 2025, with North America leading at 4 per cent volume growth. P&G’s focus is on creating business versus taking business, aiming to drive market growth through superior performance.

Retailer Strategy: Ownership of the Ecosystem

While national brands focus on individual product superiority, retailers are focusing on ecosystem superiority. Walmart’s strategy is to become a data-driven, omnichannel juggernaut. By fusing its 4,600 US stores with a world-class e-commerce platform, Walmart has turned its physical footprint into a fulfilment engine. The company’s store renovations and its retail media business provide it with a high-margin revenue stream that funds lower prices for consumers. Tesco has leveraged its Clubcard data to provide material increases in personalised offers, driving customer satisfaction to its highest level in six years. By combining Aldi Price Match with its Finest premium tier, Tesco has effectively protected its market share across all price points, seeing switching gains from both discounters and premium rivals.

The performance of these companies signals a clear divide in the health of the category.

Healthy Categories: Personal Care, Spirits, Beauty and Wellbeing, and Pet Care remain robust, as consumers are willing to trade up for products that feel personal or healthy. These categories saw volume growth even when national brands raised prices, suggesting high brand equity and consumer resilience.

Challenged Categories: General Food, Home Care, and Beverages are seeing intense competition from private labels. In these areas, differentiation is harder to maintain, and national brands are often forced into promotional battles or lose share to retailer-owned options that offer comparable quality at lower prices.

The Hollowed Out Middle: Mass-market brands that neither offer the lowest price nor a clearly superior functional benefit are under the greatest pressure. Analysts expect these mid-market players to continue to lose market share as the market bifurcates into Value and Prestige.

National brands are fighting back with massive advertising budgets and portfolio simplification, but volume recovery remains inconsistent. Retailers have a structural advantage in ecosystem data, allowing them to personalise the shopping mission in ways manufacturers cannot. Category switching is the new normal; brand loyalty must be earned on every trip through unmissable superiority. The high-income trade-down to Walmart and Tesco suggests that luxury in grocery is being redefined as High Quality, Smart Price.

In Conclusion

For executives, the 2025 performance data suggests that a brand's health is now inextricably linked to its ability to compete with a sophisticated, premiumised private-label sector. The era of driving growth through broad price increases is over. To thrive in 2026, brands must focus on volume-led growth by reclaiming relevance through functional superiority that justifies the price point. Structural efficiency will be necessary, using AI and automation to fund the marketing investment needed to compete for share of voice. An omnichannel presence is essential, as is targeting the new demographic by aligning with the smart value priorities of high-income households and the sustainability-driven values of Gen Z. The 2025 financial period has demonstrated that store brands have entered their leadership era. The winners of 2026 will be those who bring the most unconventional innovations to the shelf first, backed by credible evidence and a deep understanding of new consumer psychology.